Access Control Server

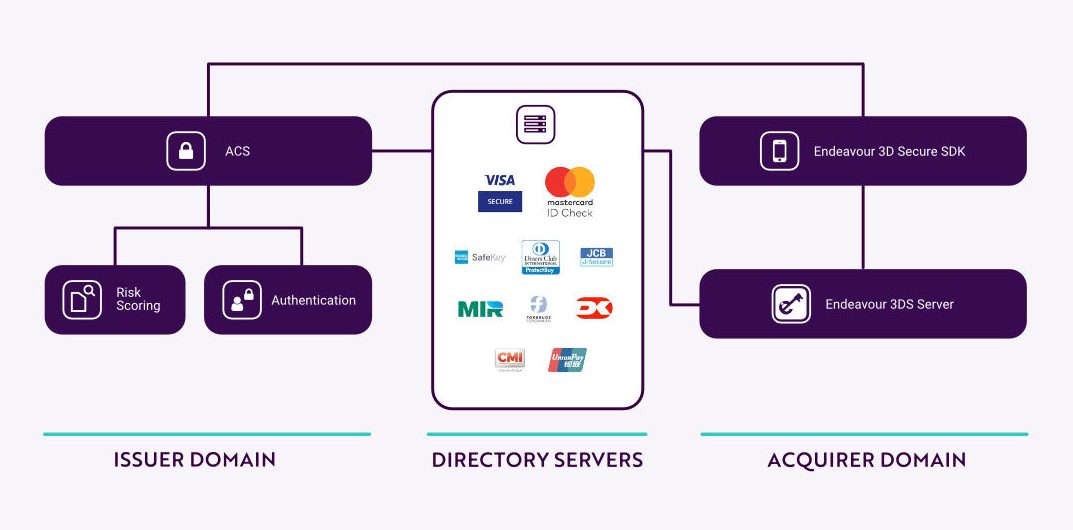

Endeavour 3D Secure stands as a comprehensive solution tailored for both issuing and acquiring institutions seeking to mitigate the risks associated with fraudulent online payment transactions through Strong Customer Authentication. Implementing the latest EMV® 3-D Secure Protocol, Endeavour 3D Secure supports advanced authentication methods, for both frictionless and SCA authentication, leveraging Transaction Risk Analysis and Risk-Based Authentication and supporting Browser, App and 3RI device channels, out of band authentication and Biometry authentication through banking apps. These features collectively enhance the overall security of online transactions while simultaneously improving the end-user payment experience.

In today’s dynamic payment landscape, consumers have an array of payment methods at their disposal, with the constant growth of e-commerce across web browsers, mobile apps, and connected devices. This surge in popularity has transformed online shopping into a convenient and efficient avenue for consumers to shop from the comfort of their homes.

The escalating number and volume of online payment transactions have, however, given rise to an increase in fraudulent activities, resulting in additional costs associated with fraud and chargebacks. Amidst this landscape, cardholders are increasingly seeking a seamless online shopping experience without compromising on robust payment security standards. In response to these evolving demands, Endeavour 3D Secure provides the ideal platform to address the challenges posed by the modern online payment environment.

Endeavour 3D Secure delivers advantages across the entire payment chain.

Cardholder Benefits:

- Enhanced confidence in online payments via web browsers or mobile applications.

- User-friendly interface: simple, intuitive, and frictionless process for a refined user experience.

- Empowerment through control of payment risk parameters.

- Consistent two-factor strong customer authentication and user experience across all digital channels.

Benefits for Merchants and Acquirers:

- Sales Growth: Experience an increase in sales.

- Liability Shift: Enjoy a granted liability shift for fraud and disputed transactions.

- Seamless Integration: Benefit from fast and easy integration.

- Progressive Security: Stay ahead with progressive security measures.

- High Conversion Rate: Achieve a high conversion rate for successful transactions.

Benefits for Issuers:

- Enhanced Product Value: Add more value to existing product offerings.

- Fraud Reduction: Experience a decrease in online card fraud and disputed transactions.

- Comprehensive Risk Assessment: Conduct deep risk assessments of online merchants, clients, and transactions.

- Progressive Security: Stay at the forefront with progressive security measures.

The Access Control Server empowers issuing institutions to engage in the 3D Secure program, ensuring the authentication of cardholders during online Card-Not-Present (CNP transactions. This is achieved through various authentication methods, including Risk-Based Authentication, One-Time Passwords, SMS OTP, Push Notifications, biometrics, and more.

The Access Control Server empowers issuing institutions to engage in the 3D Secure program, ensuring the authentication of cardholders during online Card-Not-Present (CNP transactions. This is achieved through various authentication methods, including Risk-Based Authentication, One-Time Passwords, SMS OTP, Push Notifications, biometrics, and more.

Utilizing transaction data supplied by 3D Secure Server (3DSS) and Access Control Server (ACS), the Risk Scoring Engine will assess transaction risk. Depending on the evaluated risk, the online Card-Not-Present (CNP) transaction will proceed either seamlessly or undergo authentication using the available Strong Customer Authentication (SCA) method. The issuer has fine control on the risk parameters through a sophisticated rules engine.

The 3DS Server empowers acquiring institutions to offer 3D Secure protection to their merchants. Through straightforward integration with web shops or mobile applications, merchants can secure a liability shift from card schemes in the event of online fraud.

To facilitate the integration of 3D Secure into mobile purchasing applications, mobile application vendors can leverage a certified 3D Secure SDK. This software development kit communicates with the 3D Secure Server (3DSS) to verify if the Bank entification Number (BIN) is enrolled in 3D Secure. Additionally, it interacts with the issuing bank’s Access Control Server (ACS) to provide device data and in APP authentication

Would you like more information? Let’s get in touch.

Be in the know

Industry news, events and major releases.

Let's talk payments in Amsterdam!

Endeavour 3DSecure - Authentication done right!